Take charge of your financial future with our seven-step guide to creating a financial plan. It’s designed for beginners and adaptable for any income level.

Some of the links on our website are sponsored, and we may earn money when you make a purchase or sign-up after clicking. Learn more about how we make money.

A joint study between the Consumer Federation of America and the CFP Board found that 48% of households with a financial plan described themselves as “living comfortably.” Those without a plan expressed that sentiment only 22% of the time.

This guide outlines seven simple steps to develop a financial plan, regardless of your income or financial situation.

Here’s an overview of the seven steps we’ll cover:

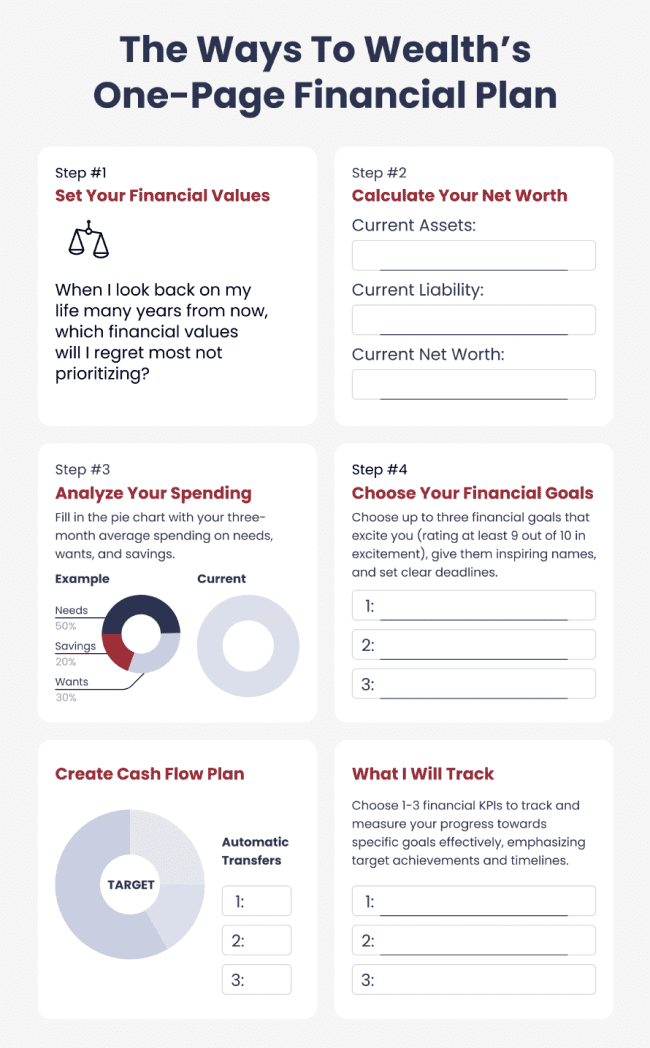

We’ve also created a one-page PDF to walk you through each step, which you can download here.

A financial plan is a document that outlines your current financial situation, future goals, and the steps you need to take to achieve those goals.

At its core, a financial plan answers three key questions:

The format of a financial plan can vary from a single page to a more detailed spreadsheet. Regardless of the format, the purpose is to provide clarity, direction, and strategies to improve your financial well-being.

There’s more to having a financial plan than setting financial goals, such as paying off debt, building an emergency fund or saving for retirement.

A well-thought-out financial plan connects these goals to something deeper — to your “why.”

This “why” is what I like to call your financial values.

Think of financial values as a set of two or three core ideas that guide your financial decision-making.

What’s important is that these values resonate with you personally. While they can vary widely between different people, I find that they typically fall into one of six categories:

The question I find most helpful here is this:

“When I look back on my life many years from now, which financial values will I most regret choosing not to prioritize?”

With that question in mind, take time now to choose the values most important to you and write them down in your financial plan.

While the general categories above are a good starting point, feel free to put your own spin on this exercise. Your values are your own.

A net worth statement, also known as a balance sheet or a personal finance statement, is a summary that shows you the value of what you own (assets) minus what you owe (liabilities).

Measuring progress is easier when a simple metric (such as net worth) tells you how you’re doing. If it’s increasing, great! If it’s not, you’ll need to consider changing financial strategies.

To get started, use our net worth template, available via Google Sheets (click the “Make a Copy” button when prompted), to help you calculate this number.

With the spreadsheet open, you’ll want to do the following:

The spreadsheet will then subtract your total liabilities from your total assets.

The figure you get from this calculation is your current net worth.

Don’t freak out if your net worth is a negative number! The point is simply to make yourself aware of your current financial reality, and then to create a plan for increasing the number over time.

With your net worth statement in hand, the next step is to analyze your current spending habits, checking for areas that are out of balance.

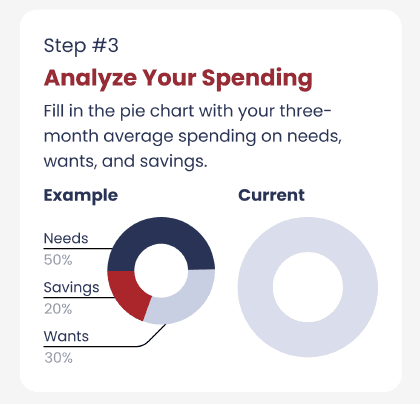

The easiest way to do this is by using the framework of the 50/30/20 budget.

The 50/30/20 budget allocates your income into three categories:

Your task is to analyze your past three months of spending to see what your percentages were for needs, wants and savings. Then, fill in the “Current” pie chart in the financial planning template with these percentages.

Pro tip: I recommend using one of the many free personal finance budgeting apps to get this data.

At first glance, many financial goals sound boring. Who wakes up excited to save for retirement or build an emergency fund?

That’s why it’s important to tie financial goals to bigger life goals.

For example, an emergency fund allowed me, as the sole income provider for a family of five, to leave the comfort of a job I held for 10 years and run this website full-time.

Building my own business was a goal I’d had for years, and a proper emergency fund (as well as a very supportive wife) helped me make that happen.

When it comes to choosing financial goals, here are three helpful tips as outlined by the financial psychologist Brad Klontz:

Your current financial situation will play a large role in the timeframe of your goals. If you’re living paycheck to paycheck, focusing on short-term goals is best.

While you want to have a long-term vision of where you want to go — e.g., saving up for a down payment on a home and retirement — focus (for now) on shorter-term goals that will allow you to get to that point.

Pro tip: If you have high-interest debt (like credit card debt) and no emergency fund, familiarize yourself with the Baby Steps process. This easy-to-understand framework will help you prioritize your financial goals.

If you have a solid foundation, such as some cash in the bank and the ability to allocate money towards goals each month, you might have a combination of short-term and long-term goals.

The aim is to have one to three goals you’re looking forward to and motivated to accomplish.

If you want to take a deep dive into financial goal setting, enter your email address in the form below to get access to our free workbook:

Master Your Finances

Get financial control with our step-by-step goal-setting workbook. Opt-in below to receive the free PDF guide instantly.

We won’t send you spam. Unsubscribe at any time.

Cash flow planning — i.e., how you decide to allocate your income — is the most important aspect of financial planning.

In Step #3, you analyzed your spending to determine where your money has gone, dividing it into needs, wants and savings.

The idea here is to take your financial goals and design a spending plan around these goals.

For example, imagine your take-home pay is $5,000 per month and your current spending is allocated as follows:

Now, integrate the financial goals you choose in Step #4 into this plan.

Let’s assume today is January 1st, 2024, and we have the following goals:

All in all, your goals require you to:

This requires $1,166 of savings per month, which is over your current 20% of savings.

So you have two choices:

The choice is yours. But the important thing is to understand what the opportunity cost is upfront, keeping in mind that financial planning is about making sure you prioritize what matters to you.

The final step here is to set up automatic transfers to align with your paycheck dates. If your direct deposit hits on the 1st and 15th, schedule transfers for shortly thereafter.

For example:

Transfers should go to separate savings accounts, so you understand this money is separate for your everyday living expenses.

Lastly, in the financial planning template, fill in the “Target” spending plan to reflect the ideal distribution of your income across needs, wants, and goals, detailing the automatic transfers you’ll set up to ensure these goals are achieved.

Bank organizational tips: While some banks allow you to create sub-savings accounts, many do not. If you’re not willing to switch banks to one that does, alternatives are as follows: If your bank has a checking and a savings, utilize the savings for your goal. Have your income get funneled into your checking, which should be enough to cover your bills and make payments towards your goals. (This only works if you have one goal and don’t currently utilize the savings account.) Or, you can utilize your investment brokerage account’s money market fund or cash management account. Finally, you can open a new bank account just for that. Overall, I find it very helpful not to mix multiple goals into one savings account, as it’s easier to track the progress towards each when they’re separate.

A KPI, or key performance indicator, is a business term for a variable that helps you analyze your current situation. In other words, KPIs are facts and figures that tell you whether you’re trending in the right or wrong direction.

When it comes to financial planning, your KPIs should show you exactly how you’re progressing towards your financial goals.

For example, if your goal is to build an emergency fund of three months of expenses, your KPI could be:

KPI = Current Emergency Fund Savings / (Monthly Expenses X 3)

One trick for setting powerful KPIs is to track the date you’re on-target to accomplish your goal.

For example, instead of saving a certain amount for retirement, track the age at which you’ll achieve financial independence.

Or, instead of tracking the total amount of debt, track the date you’ll pay off your debt. (We’ve designed a free spreadsheet to help you do this, which you can read more about here.)

Why choose dates over dollar amounts? In my experience, dates are far more motivating. In addition, they often tell a more realistic story about your progress.

Of course, KPIs are going to depend on your goals (which depend on your values!) but here are some of the most common KPIs in personal finance:

KPIs are only useful when used over time as a way to measure your progress. If the date you’re expected to be debt-free is getting farther and farther away, it should be obvious that more changes are needed.

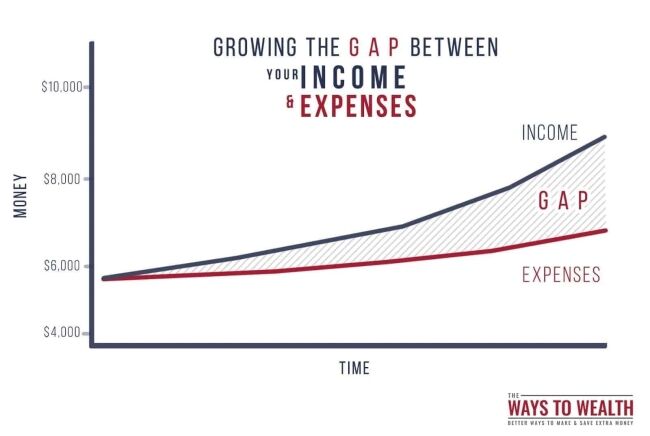

The most important thing you need to understand about financial goal setting is that the speed at which you achieve your goals comes down to the gap between your income and expenses.

Benjamin Franklin said:

“There are two ways to increase your wealth. Increase your means or decrease your wants. The best is to do both at the same time.”

Saving money, at first, is often a lot easier than earning more. However, saving money comes with diminishing returns. In other words, before long you’re driving across town to save three cents a gallon on gas.

Making money, on the other hand, is far more scalable. There’s no limit to how much you can make.

As such, once you make some smart moves to get your spending down, it’s best to shift your effort towards making money.

A 2015 study by Dr. Nathan Hudson and Dr. Chris Fraley found that personality can be changed through goal setting and continuous effort.

A lot of people avoid financial goal setting and planning because they think they’re not good with money — that personal finance, or money in general, is something they’ll just never be good at because of some inherent trait.

The truth is the opposite. Research shows that through goal setting, and putting in the effort to achieve those goals, you can indeed change how you think about yourself. And that can fundamentally reshape your financial future.

For example, you can change yourself from someone who thinks they’re not good at managing money to a diligent and disciplined saver, a high income earner, or the type of person that retires early.

You get to choose. It all starts with setting the right goals and putting the right plan in place to see those goals through to completion.

Join over 10,000 subscribers and stay ahead with personal finance insights, the best deals, and the best money-making opportunities every Friday.